Some might believe that the overarching real estate dynamics are fairly similar all over the world.

However, a deeper analysis of the two largest markets in the globe (U.S. and Europe) shows a more nuanced picture. The European market stands out with its structural demand drivers and one of the highest supply barriers. In this edition of our “Why invest in …?” series, we will unveil the key features that set the European market apart.

However, a deeper analysis of the world’s two largest logistics real estate markets reveals differences beneath the surface. In this article, we uncover the unique features of the European market by comparing it to the U.S., which is considered a leading and most mature market globally.

Economic expansion supports all real estate sectors, including logistics. However, as seen in Exhibit 1, the growth of occupied stock outperformed real GDP growth significantly in nine European countries in the period 2013-2023. During this period, economic growth was ~14 %, while occupied stock almost doubled. In the U.S., these two metrics are more closely tied. The strong outperformance of logistics growth compared to GDP growth in Europe is due to the importance of structural drivers, creating resilient demand. These structural drivers include rising nearshoring requirements or undersupplied markets.

Note: EU statistic based on national vacancy levels of 9 countries (Deutschland, Frankreich, Vereinigtes Königreich, Niederlande, Polen, Tschechische Republik, Slovakia, Spain and Italy).

As it’s illustrated in Exhibit 2. Over time, this adoption rate is rising, creating structural demand. European markets are undersupplied as Pan-European networks and institutionalization of the asset class only emerged in the early 2000s, driven by the Schengen agreements. The U.S. market is more mature, with initial drivers being the development of the interstate highway network in the 1950s. The level of stock per capita across Europe differs as the role in the supply chain (Pan-EU or domestic focus) and maturity differ. Particularly, CEE and Southern European countries are relatively undersupplied. Expectations are that this trend of a rising adoption rate will continue, although it is not expected to reach U.S. levels due to differences in geography and wealth.

Across Europe, land has become increasingly scarce, particularly in locations close to consumption centres. Even when a developer has acquired a certain land plot, regulation procedures are lengthy and complex. Based on World Bank data, the average time to obtain a construction permit is over 170 days within the 10 countries GARBE is active in. In perspective, the U.S. average is more than half of that (81 days). Particularly, Western European markets have become stricter, fuelled by limited land and NIMBY discussions.

When construction of a new development is underway, Built-to-Suit (BTS) developments are more common in Europe compared to the US. In the U.S., 84 % of completions were labelled as speculative in 2023, while in Europe, the ratio of speculative as a percentage of total construction varied for key logistics markets between 64 % (Italy) and just under 40 % for Benelux and Germany. This lower share is driven by multiple factors, including culture (risk avoidance), market transparency, lengthy development timelines, and constrained markets. Overall, a lower share of speculative space mitigates the risk of markets becoming oversupplied quickly.

Supply constraints and structural demand drivers have led European market vacancy levels to align with U.S. levels in the last ten years. In 2023, the Pan-European market vacancy increased by ~100bps but remains below 4 %. The U.S. recorded an uptick as well, with vacancy increasing by 210bps to 5.2 %. This increase of market vacancy was driven by recent high development activity and softening occupier sentiment. In the first half of 2024, a minor increase in vacancy is expected in Europe, but at lower levels compared to the U.S. due to lower development volumes and a focus on BTS. A decline in vacancy is expected for both regions in second half 2024 onwards as current construction pipelines are lower.

Note: EU statistic based on national vacancy levels of 9 countries (Deutschland, Frankreich, Vereinigtes Königreich, Niederlande, Polen, Tschechische Republik, Slovakia, Spain and Italy).

Europe has seen significant rising rents in recent years, but at a later stage of the cycle and at a slower pace compared to the extraordinary levels seen in the U.S., which recorded double-digit growth for a couple of years in a row. Another key difference between Europe and the U.S. is that inflation-adjusted rents (real rents) are still below 2006 levels in many markets. The European average is around minus 10 %, while the U.S. is around plus 45 %. From an investor perspective, this implies there remains significant rent growth potential before markets become overpriced. From an occupier perspective, this means real estate costs don’t account for a higher share in core supply chain costs (fixed costs, including rents, 3-6 % ).

Cap rates in Europe and the U.S. have seen a fairly comparable trend of strong compression from 2010 to 2022, followed by expansion and stabilization in the last two years. In the long term, the cap rate spread between both regions has narrowed to close to zero, reflecting the rising institutionalization levels in Europe.

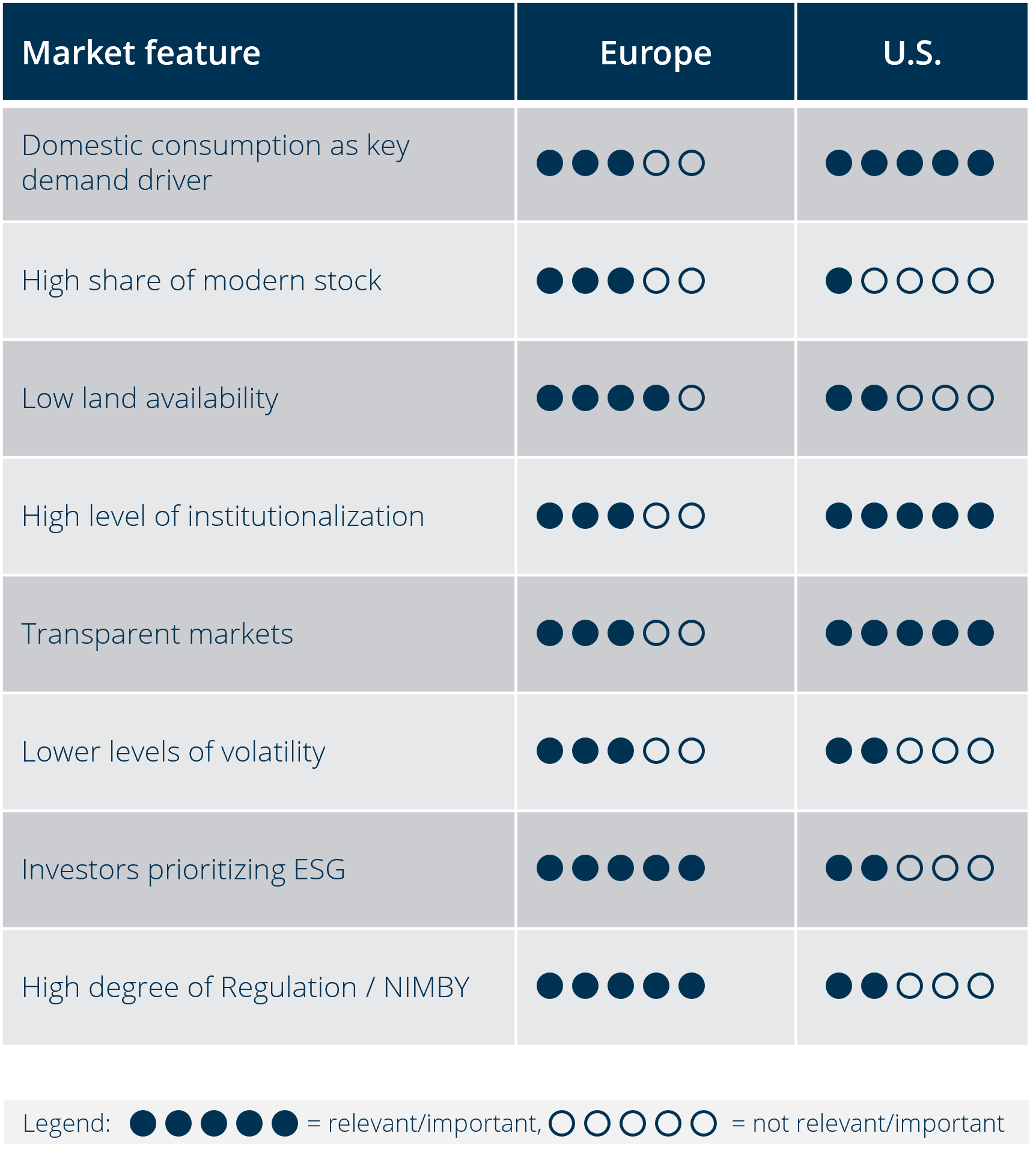

By reviewing a range of market features, it’s clear that the structure of the logistics markets in the two regions differs. Europe stands out in terms of prioritizing ESG and stricter regulation, while the U.S. market is more transparent and institutionalized, but a range of historic KPIs are more volatile.

Europe has historically recorded lower volatility compared to the U.S., particularly concerning rents, capital values, and returns . This is a typical characteristic of the European market, especially for markets on the continent. A relatively stable market is one of the drivers for non-domestic investors to invest in the European logistics real estate market.

ESG is important in the U.S. as well, but the overall consensus is that Europe is further ahead across investors and occupiers.

To conclude, at first glance, logistics buildings and types of locations are fairly comparable in both regions. However, beneath the surface, there is a wide variety of characteristics, offering opportunities and challenges. The European market offers unique and attractive investment features supporting long-term growth.

From a demand perspective, these drivers include undersupplied markets, e-commerce growth in line with pre-pandemic levels and increasing nearshoring activities taking place on the continent. From a supply perspective, rising barriers to new supply and regulatory measures mitigate the risk of oversupply. These supply and demand dynamics support long-term rent growth and continued capital interest. The U.S. market is more mature and has shown strong rental growth in the last decade.

We use cookies on our site. Some of them are essential, while others help us to improve this website and to show you personalised advertising. You can either accept all or only essential cookies. To find out more, read our privacy policy and cookie policy. If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. You can revoke or adjust your selection at any time under Settings.

If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. This is an overview of all cookies used on this website. You can either accept all categories at once or make a selection of cookies.