GARBE PYRAMID MAP: Europe’s Logistics Real Estate Markets Expect Muted Momentum and Selective Growth through 2030

News 29/01/2026

- Rental growth dynamic expected to slow noticeably over the next five years

- Predominantly stable yields in European core markets with occasional market opportunities

- Increasing self-sufficiency of European supply chains and production generates positive demand impulses

Hamburg, 29 January 2026 – The economic and geopolitical environment has become much more volatile over the past years, and there are currently no signs suggesting a stabilisation of the operating conditions. At the same time, no major economic impulses from a broad-based upturn are to be expected in the near term. With this in mind, it is reasonable to assume that the market dynamics in Europe’s logistics real estate markets will largely remain muted in the coming years. While the annual rent growth rate still averaged 5.7 percent during the past five years (CAGR Q4 2020 through Q4 2025), the forecast for the next five years predicts an increase by only 1.9 percent annually. Analogously, the yield side also points to an emergent phase of stabilisation: Since the turning point at the end of the previous market cycle in Q2 2022, the average prime yield across the 122 regions rose from 4.6 percent to 5.7 percent, with the most recent quarters revealing an emergent trend toward yield compression. In the years ahead, the moderate decline in yields is predicted to continue across the 88 forecast markets, down to a level of 5.2 percent by 2030. The vast majority of European logistics real estate markets are expected to see a slight yield compression, while some regions are likely to follow a sideways movement. These are the findings that GARBE Research disclosed in the latest edition of its GARBE PYRAMID MAP, a forecast developed together with Oxford Economics that covers 88 out of 122 European logistics regions overall.

Market Performance Decoupling from Geopolitics

Striking to note is that Europe’s logistics real estate markets are progressively decoupling from geopolitical events, whose immediate impact on these markets is diminishing accordingly. More and more often, markets respond with a certain delay, while market development differs considerably from one region to the next. “A fundamental stabilisation of the geopolitical environment that many had long been hoping for is nowhere in sight. However, market players are increasingly coming to terms with the new reality, are abandoning their wait-and-see attitude and have begun to resume trading,” said Tobias Kassner, Head of Research & ESG at GARBE Industrial. “Given the market corrections of the past few years, we believe the time for sweeping adjustments has come and gone. Stability is here to stay and growth is happening – albeit selectively and strongly dependent on location.”

At the same time, the increasingly opaque and unpredictable market environment exposes investors and operators of logistics properties to ever-tightening requirements. Things decisive for success include therefore a clear-cut strategic trajectory, in-depth knowledge of the local market and a consistent implementation on the location level and portfolio level. “In a market defined by a high degree of uncertainty, the outcome depends less on the cycle than on the quality of the asset management. Stable cash flows, active contract management and tenant management along with tight control on the property level represent the key success factors today,” said Tom Herrschaft, Head of Real Estate Management at GARBE Industrial.

Selective Rent Growth and Stable Returns

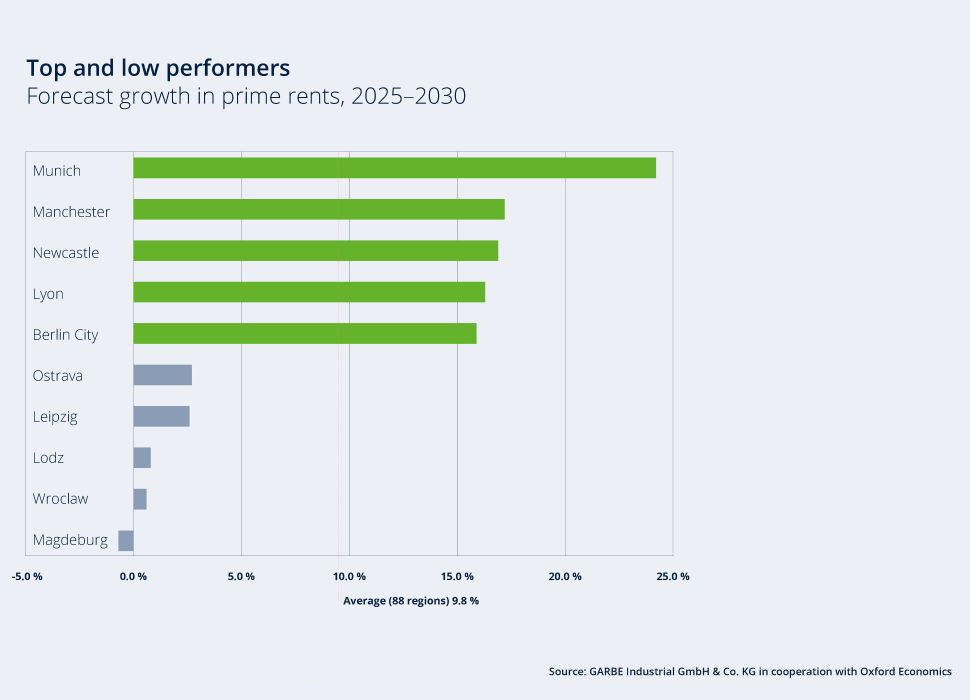

Despite the generally muted market dynamics, the GARBE forecast identifies a large number of European logistics markets that continue to show potential for growth. In fact, prime rents are expected to increase by more than ten percent in 45 of the analysed regions between now and 2030. The strongest impulses are coming from established core markets in countries like Germany, the United Kingdom, France and the Netherlands. One market that clearly stands out from the rest of the field is Munich: Strong local demand, a structurally short supply and the economic clout of the region suggest that the dynamic rent growth of recent years will continue here.

As far as yields go, the outlook is cautiously optimistic, with established markets likely to take the lead. The most promising performance prospects are offered primarily by liquid core markets where moderate rent growth coincides with stable yield rates.

A closer look at the United Kingdom and France provides a clear idea of the current market situation and future development perspectives. Both markets exemplify how demand, rent growth dynamics and return profiles in the established logistics regions of Europe are trending at the moment.

Market Insights United Kingdom

The logistics real estate market in the United Kingdom, even as it is consolidating, continues to offer potential for growth. Worth noting is the increasing interest that Asian e-retailers with concrete expansion plans have shown lately in easily accessible ports. Demand is generally strong for large-scale logistics properties in established regions like North West England or the Midlands with its economic regions of Manchester and Birmingham, which in turn has fuelled real rent growth in these submarkets. The defence and aviation industries have also increasingly come to the fore as drivers of demand. The limited availability of suitable properties continues to sustain the level of rents.

Market Insights France

The French logistics real estate market has proven stable and comes with a cautiously positive outlook. Demand continues to be strongly buoyed by in-store and online retailing. Additional impulses are generated by the defence and aviation sectors, particularly in regions like Toulouse. At the same time, the demand focus is shifting from older stock to modern ESG compliant logistics real estate. Vacancies are concentrated primarily in the northern regions and affect mainly legacy properties.

Comparable Impulses across Borders

“The structural drivers at work here resemble those across the border. E-commerce remains a key demand factor, but the same is increasingly true for Asian retailers seeking to expand their footprint in Europe. Changed trade flows, realigned supply chains and the focus on strategic resilience and defence will define the logistics real estate markets for a long time to come and generate decisive impulses,” said Kassner.

For more figures and methodological details, please see the interactive GARBE PYRAMID MAP. The data referenced in our press release are sourced from the PYRAMID project.