GARBE PYRAMID MAP: Broad-Based Stabilisation with Selective Upward Trends on European Logistics Real Estate Markets

News 15/01/2026

- Europe eludes widespread yield compression; opportunities in selected core markets

- Positive market signals, most notably in the United Kingdom, Spain, Italy and Germany

- Munich continues to pull away from the national rent level and thereby consolidates its competitive position internationally

Hamburg, 15 January 2026 – Europe’s logistics real estate markets are showing signs of broad stabilisation, accompanied by selective upward trends. Especially during the fourth quarter of 2025, certain regions recorded positive growth. Prime rents increased by an average of 1.3 percent over the course of the year, while yields softened by six basis points. These are the findings of GARBE Research in its latest GARBE PYRAMID MAP, which will be published on 29 January 2026. The GARBE PYRAMID MAP is an overview of prime rents and prime net initial yields for the 122 most important logistics real estate submarkets in 25 European countries.

“The anticipated broad trend reversal is not happening for the time being. What we are seeing is a stabilisation of a clearly selective nature,” said Tobias Kassner, Head of Research & ESG at GARBE Industrial. continue to require long-winded decision-making processes in many locations, according to Kassner, while the gap between prime and secondary locations keeps widening. “Deals are happening here and there, just not everywhere. If you want to seize opportunities, you must know the places where it is worth looking.”

Under the current parameters—especially against the background of changed geopolitical developments—classic monetary policy impulses and macroeconomic factors no longer function the way they used to. “As a result, in-depth market know-how and experience attain far greater significance. In the current market environment, real asset value is driven primarily by active asset management and pinpoint positioning at the property level,” said Kassner.

Great Britain: Strong Market with Robust Foundation

The British logistics real estate market is one of the structurally strongest not only in Europe but worldwide. Demand is driven by strategies to strengthen supply chain resilience and by structural impulses from the defence and e-commerce sectors. As a result, take-up is already well above pre-pandemic levels. Transactions in central England have contributed significantly to this.

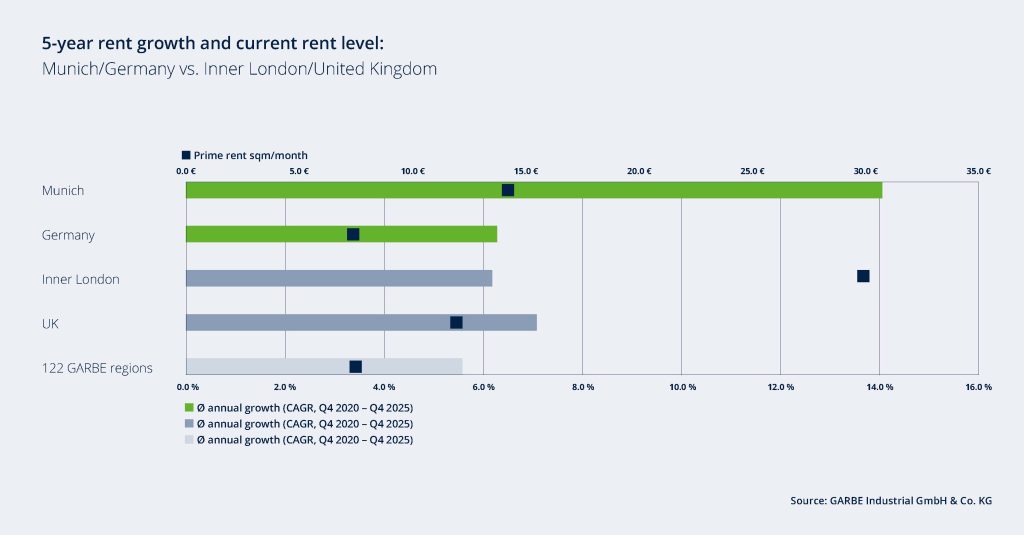

As far as rental growth goes, ten of the eleven regions analysed in Great Britain and Northern Ireland are above the European average of 5.6 percent, with a compound annual growth rate (CAGR) of 7.1 percent. The rent ranking of European submarkets shows Inner and Greater London in the lead. Inner London also counts among the European lead group on the yield side with a prime yield rate of 4.6 percent.

“Great Britain remains the strongest logistics real estate market in Europe,” said Kassner. “The core regions continue to indicate substantial rental growth. Liquidity is high, even if we continue to have a buyer’s market for the time being. The long-term foundation is reassuring despite short-term volatility.” According to Kassner, this development can be interpreted as an auspicious sign for markets in mainland Europe because market movements in Great Britain tend to precede analogous trends on the Continent.

Source: GARBE PYRAMID Q4 2025

Germany: Rent Hotspots and Selective Recovery

In Germany’s core regions, the market presented a stable picture in 2025, with robust demand for space and selective rental growth. Munich and Berlin City are clearly among the star performers. While Munich represents a homogeneous market citywide, there were significant differences between Berlin’s core market and its periphery. Over the past five years, Munich has evolved into the priciest logistics location in the eurozone, and it continues to pull away from the national average at a steady pace. Since the fourth quarter of 2020, the two regions have also taken the lead with regard to rental growth: The average annual growth rate (CAGR) is 14.1 percent for Munich and 12.7 percent for Berlin City.

There are other top regions in Germany that show a stable performance, such as Hamburg, Düsseldorf and Frankfurt. Upward momentum is also reported from Bremen: Long considered a problem child, this market saw a number of vacant units successfully rented out in 2025 and is showing potential for rental growth.

Spain: Strong Dynamics of Rental Growth and Demand Coincide with Short Supply

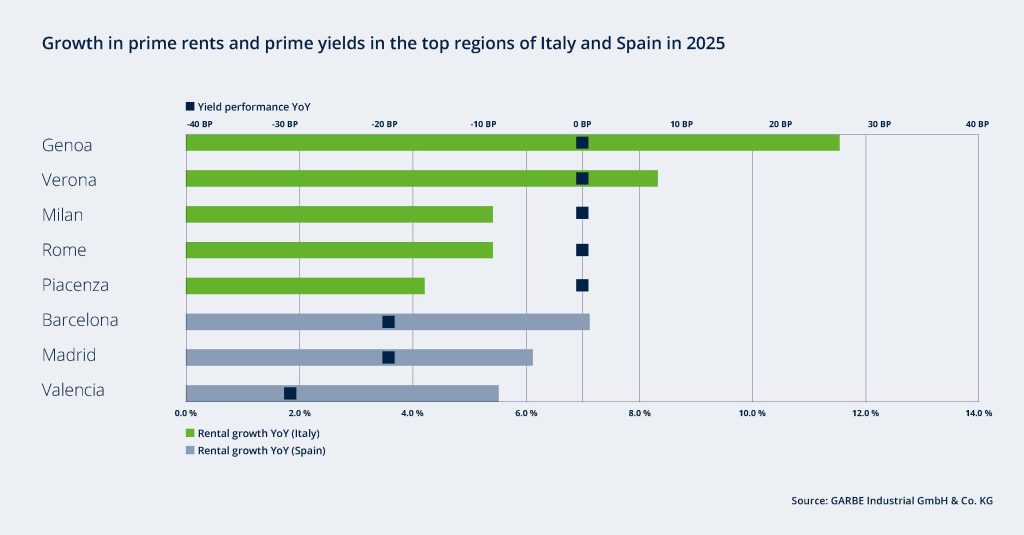

Spain proved to be one of the relative outperformers in Europe’s logistics real estate market in 2025. Rent rates surged in the core regions of Barcelona, Madrid and Valencia. All three regions count among the ten most dynamic markets in the GARBE ranking. Especially in central locations of Madrid and Barcelona, a structurally supply shortage coincides with persistently strong occupier and investor demand. There are few speculative developments in the pipeline, and this puts additional pressure on rent rates. Valencia keeps gaining importance as a result of numerous infrastructure measures, most notably the expansion of the port.

Kassner commented: “Spain combines rental growth with short supply and international investor interest in a way that currently has few parallels in other markets. With yield rates at five percent while rent rates are rising, the market remains particularly attractive for value-add and core+ strategies.”

Italy: Early Cycle with Structural Potential

Italy emerged as one of the most fascinating logistics real estate markets in Europe last year, driven by stable demand, limited supply and an active investment environment. “Spain is already showing the onset of yield compression, whereas yields in Italy are still moving sideways – leaving further room for manoeuvre from an investor’s point of view. Especially for developers and core+ strategy investors, this suggests attractive opportunities to enter the market,” as Kassner elaborated.

Occupier markets have more or less stood their ground, buoyed by a high share of build-to-suit and build-to-own projects as well as by long lease terms. At the same time, a complex licensing environment limits the volume of new construction, perpetuating the supply shortage.

Particularly the core regions of Milan and Rome boasted a stable performance. Strong growth momentum is reported from Genoa, Verona and Piacenza. Year on year, prime rents increased by 11.5 percent in Genoa and by 8.3 percent in Verona between year-end 2024 and year-end 2025 while Piacenza experienced significant growth, particularly during the second half of 2025.

Source: GARBE PYRAMID Q4 2025

For more detailed statistics and methodological information, see the interactive GARBE PYRAMID MAP whose latest update will be available by 29 January 2026. The data referenced in our press release are sourced from the PYRAMID project.